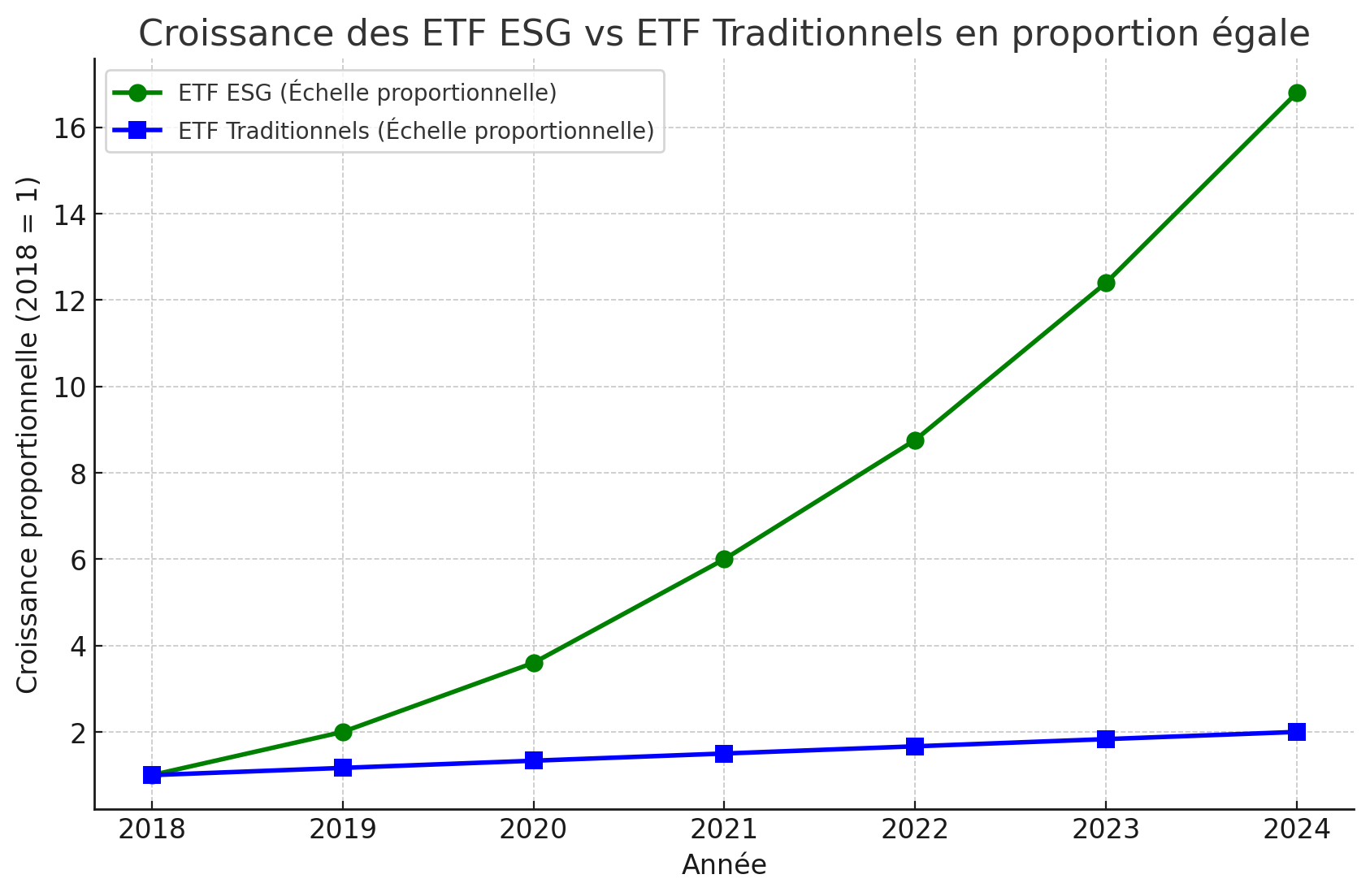

The ESG ETF market is growing rapidly (+35% in 5 years), but few solutions exist on the blockchain. Our model combines the growth of traditional ESG ETFs with the benefits of decentralized finance, aligning with Index Coop's vision.

🌍 Expansion

- ⛳ 67% of investors want + active ETFs

- ⏳ 80% of ESG funds will have to be "green" by 2025 (EU regulations)

- 💰 Massive influx of capital: $50 billion invested in 2023 despite a volatile crypto market [Morningstar]

- 📈 Rapid growth: Factors influencing performance: In 2022, ESG funds had underperformed due to rising interest rates and the poor performance of technology stocks, in contrast to the rise in energy stocks. In 2023, their performance improved despite lower fundraising, attributed to fears of greenwashing.

- 🌱 Transition to sustainable finance: 79% of institutional investors integrate ESG into their decisions [PwC].

- 🌿 🛡️ Regulation and transparency: Revision of the SFDR Regulation: To fight against greenwashing and to clarify truly green investments, the SFDR regulation should be revised, thereby strengthening investor confidence in ESG products.

- 🍀 Future projections: ESG investments in the U.S. have grown from $0.8 trillion in 2015 to $4.5 trillion in 2021, with projections reaching $10.5 trillion by 2026. 79% of institutional investors integrate ESG into their decisions [PwC].

🚀 Why ESG Crypto ETFs are a Unique Opportunity

- 🔹 Lack of existing options: Less than **10 ESG crypto ETFs** worldwide.

- 🔹 Investor expectation: 67% of crypto holders want ESG [CoinShares] products.

- 🔹 Regulatory framework: The EU Taxonomy favours ESG ETFs in Europe.

📊 Comparison with Other Crypto ETFs

| Criteria | BubbleChain Index | Grayscale Bitcoin Trust | Hashdex ESG Bitcoin ETF |

|---|---|---|---|

| Multi-crypto ESG | ✅ Yes | ❌ No (BTC only) | ❌ No (BTC only) |

| EU Taxonomy Compliance | ✅ Yes | ❌ No | 🔹 Partial |

| Diversified Assets | ✅ Yes | ❌ No | 🔹 Bitcoin & Ethereum |

| Long-term Return Potential | 🔹 High | 🔹 Medium | 🔹 Medium |

💡 Invest in a High-Growth Opportunity

BubbleChain Index offers access to a fast-growing market with a unique ESG positioning.